Significant changes have arrived when it comes to flood insurance. On April 1, 2022, the Federal Emergency Management Agency (FEMA) rolled out its new system of determining flood insurance premiums, called “Risk Rating 2.0”. It’s the most significant update since the National Flood Insurance Program began in 1968.

About the National Flood Insurance Program

Flood insurance is a separate policy covering buildings, their contents, or both. Experts say just one inch of floodwater can cause up to $25,000 in damage. So having this coverage can help you recover faster from a flood.

The National Flood Insurance Program provides insurance to property owners, renters, and businesses. FEMA manages the program, and more than 50 insurance companies offer it to the public.

About Risk Rating 2.0

The NFIP determines a property’s flooding risk and what it charges property owners for a policy.

In the past, FEMA determined rates by worst-case-scenario floods that were supposed only to happen every hundred years or so.

After a decade of development, FEMA officially unveiled the new flood insurance pricing system in October 2021. It is now in effect for new NFIP policies and policy renewals after April 1, 2022.

The new system prices each property individually instead of by flood zone. It considers things like how close the property is to water, the elevation of the land, square footage, and flooding history.

The new rating system affects NFIP risk-based rates and does not change the maps or insurance requirements. For some policyholders, rates may go down. Others may see increases. The good news is that any increase cannot exceed 18 percent per year.

The Association of State Floodplain Managers and the Pew Charitable Trusts have created an interactive map where you can see how premiums have changed by zip code due to Risk Rating 2.0.

What Flood Insurance Covers

Flood insurance can protect your business or property from damage caused by heavy rains or other weather events where water accumulates on normally dry land.

- Building Coverage protects physical structures, including electrical systems, plumbing, appliances, permanent carpeting, and permanently installed features.

- Contents Coverage insures your belongings, including furniture, electronic equipment, and portable appliances.

The NFIP encourages people to purchase both types of coverage. According to FEMA, 25% of flood insurance claims are from policyholders outside a high-risk area.

Flood Insurance Cost

How much is flood insurance? The cost will depend on your risk, policy type, and coverage. NFIP deductibles can range from $1,000 to $10,000 per year.

An alternative to NFIP coverage is private insurance, purchased through independent insurers. Private flood policies may have higher coverage limits to insure a high-value home and high-value possessions. Premiums for private insurance can vary depending on your coverage limit, the location of your home, and your deductible.

Flood Insurance Tips

Here are some tips for policyholders regarding Risk Rating 2.0 from the Coalition for Sustainable Flood Insurance:

For existing policyholders:

- Renew your existing policy and maintain an active policy. By keeping an active policy, you will stay on the Congressionally-mandated glide path, limiting annual increases on premiums to 18% for primary residences and 25% for non-primary homes and commercial properties.

- Assign your policy to a new property owner. If you decide to sell your property and have an active policy, you can assign that policy to the subsequent property owner, who will benefit from a gradual ramp-up to the new risk rate premium.

For new policyholders:

- Assume an existing policy. If you are buying a property, ask if that property has a current NFIP policy. If the property does have an active policy, assume that policy so that you will be on the glide path to a full-risk rate, just as a current policyholder would.

- Consider undertaking mitigation measures. FEMA has identified three mitigation measures that can reliably lead to discounts under RR2.0: elevating properties on posts, piles, or piers, elevating machinery and equipment above the first floor, and installing flood openings in a building’s enclosure.

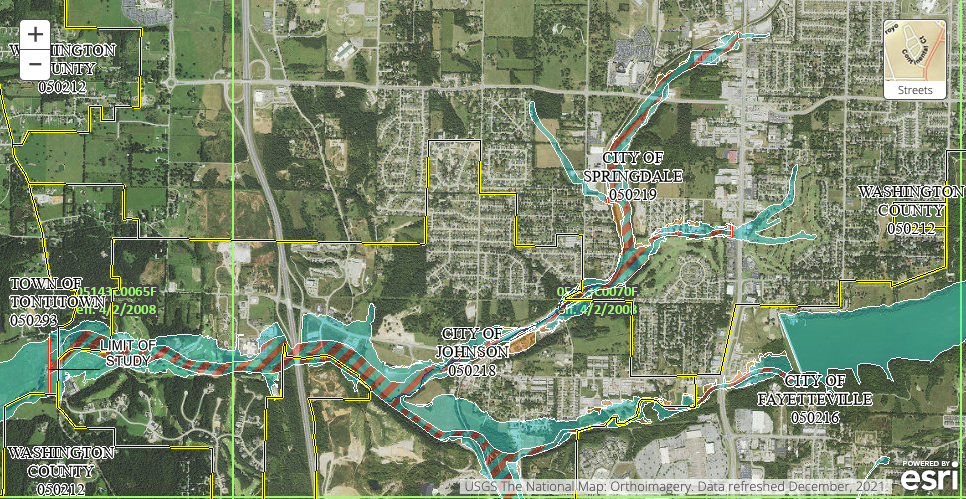

New Flood Zone Maps Ahead

The revised Risk Ratings aren’t the only changes in store. FEMA is also attempting to update its flood-zone maps. When that happens, insurance rates will change again. The revised flood maps may take effect late in 2022 or early in 2023.

Farris Insurance Can Help You With Flood Insurance

Farris Insurance Agency can help you navigate these significant changes. We can help you find the best policy for your needs, whether insuring a business or a home.

We serve businesses and people across Northwest Arkansas, including Springdale, Fayetteville, Bentonville, Rogers, Benton County, and Washington County. Contact Farris Insurance at (479) 756-6330 and get a flood insurance quote today.

Tornado Insurance

Tornado Insurance